Environmental, social and corporate governance (ESG) was a hot topic once again in the SS&C Intralinks 2024 LP Survey, produced in association with Private Equity Wire. Against the backdrop of a myriad of themes in the ESG space — from differing forms of implementation to its impact on U.S. politics and the global green agenda — allocators see room for progress.

The appetite for ESG is compelling. LPs agreed strongly with the statement that “an engaged approach to ESG issues makes a manager more appealing.”

The annual survey measured the sentiment of 251 investment professionals who work in the private markets, including family office allocators, portfolio manager/asset managers, pension funds and wealth managers. A significant majority (82 percent) are based in Europe, the Middle East and Africa (EMEA) or North America (NA). The survey provides key indicators that will influence LP decisions over the next 12 months and areas of potential improvement for general partners (GPs).

In the realm of ESG, there was room for progress concerning ESG investing. Various ESG frameworks are presently in use by LPs, with the United Nations Principles for Responsible Investment (UN PRI) most favored but by less than half (44 percent), showing the lack of consensus in this area.

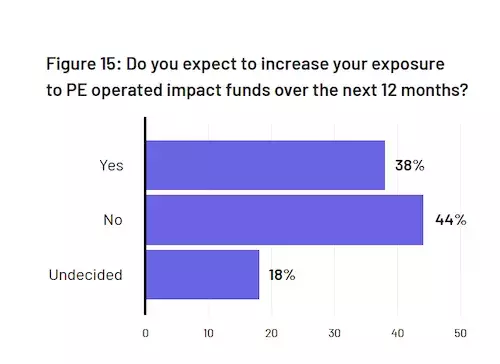

However, the appetite for ESG is undeniably strong. Almost two-fifths (38 percent) plan to increase exposure to private equity-operated impact funds over the next 12 months, with the remainder either not looking to increase (44 percent) or undecided.

GPs are increasingly aware of the need to speak to LPs about ESG in a language they understand.

“I think we all need to explore what we mean by ESG and what it means to our clients,” said Robyn Grew, CEO of Man Group, the world’s largest listed hedge fund manager, speaking at an event last year. “There isn’t a consistent global interpretation of what ESG means,” she said.

There is a very good reason for GPs to focus more on ESG — it is an area where they can stand out with prospective investors. LPs overwhelmingly agreed with the statement that “an engaged approach to ESG issues makes a manager more appealing.”

Forty percent of LPs agreed with the statement and a further 17 percent strongly agreed.

Growing interest

“There is growing interest in private markets, especially private equity, towards sustainable and socially responsible investments,” says Adam Milgrom, director at Tripple family office in Australia.

“Investors are becoming more discerning about the long-term consequences of their investment decisions, and private markets provide unique opportunities to engage with emerging industries that have social or environmental benefits, such as Clean Energy, Sustainable Agriculture and Financial Inclusion.

“As we move through 2023 and into 2024, we expect the interest in impact investing within private markets to continue growing, driven by societal shifts, evolving investor preferences and the global impetus towards sustainable development.”

ESG takeaways

How can GPs best capitalize on this growing interest? The 2024 LP Survey provides valuable insights for GPs by asking investors about specific aspects of ESG and the investment process. Here are five takeaways:

1. Integration of ESG factors through the deal cycle impacts manager selection.

Almost half (49 percent) of respondents said the integration of ESG factors through the deal cycle impacts manager selection. A fifth were neutral, meaning only a minority of LPs said ESG factors had no bearing on whether they choose to invest or not. ESG is increasingly hard to overlook as a GP.

2. LPs need better tools to evaluate managers' commitment to ESG.

Fifty-seven percent of LPs agreed with this statement, demonstrating the extent to which allocators are searching for ways of checking GP claims when it comes to ESG. There is a high amount of innovation in this area, meaning that those tools are improving all the time and a GP’s words need to be backed up by actions.

3. The quality of ESG data is increasingly a central tenet of ongoing portfolio monitoring.

A majority of LPs recognize the growing significance of ESG data quality: For 40 percent, the quality of ESG data has emerged as a pivotal element in their continuous portfolio monitoring process. Only 30 percent expressed a neutral stance.

4. LPs are relaxed about seeing annual updates to ESG policies.

There was more LP disagreement (43 percent) than agreement (27 percent) with the statement: “We would divest from a manager if they were not willing to show us their updated ESG policy on an annual basis.” This indicates a relatively relaxed LP attitude to seeing updates every year.

Opinion was divided on ESG due diligence, with roughly the same amount planning to increase it when dealing with GPs, as not (41 percent versus 37 percent).

5. Alpha generation trumps ESG criteria for LPs.

Alpha remains critical. A quarter of LPs believe the role of ESG criteria in the investment process is as important as a manager’s ability to generate alpha in their funds — while 44 percent disagree (the remainder were neutral).

Conclusion

This year’s survey results underlined the fact that GPs cannot ignore ESG factors. Engagement is not necessary to win allocations from LPs, but for a sizeable number, it is imperative.

GPs who lack an ESG policy risk missing out on allocation opportunities. The other overarching key finding from the 2024 LP Survey relates to data. Across all segments of the private markets, data is increasingly critical and LPs are actively seeking innovative tools to help them enhance their tracking, monitoring and analysis of GP reports and materials.

GPs take note: LPs believe an engaged approach to ESG makes a manager more appealing. Not having an ESG story to tell is increasingly no longer a tenable option.

The 2024 SS&C Intralinks LP Survey is available to download here.