Midwest BankCentre

Midwest BankCentre Strengthens Security and Increases Business Velocity with Intralinks VIA®.

Midwest BankCentre takes a proactive approach to security to protect customers from fraud. The bank has enacted rigorous security procedures in every aspect of daily operations and offers customers a telephone hotline to report any unsolicited requests for information regarding their Midwest BankCentre account.

SITUATION

Midwest BankCentre is in the process of expanding through acquisitions. To keep pace with the changing regulatory environment, they needed a fast and flexible way to scale its secure information sharing and collaboration capabilities. As the Senior Vice President – Operations, Larry Albrecht is the board-designated Chief Information Security Officer for Midwest BankCentre. He was responsible for solving this new functional requirement for the bank. Specifically, Albrecht needed to enable secure internal and external information sharing with regulators, examiners, and business partners.

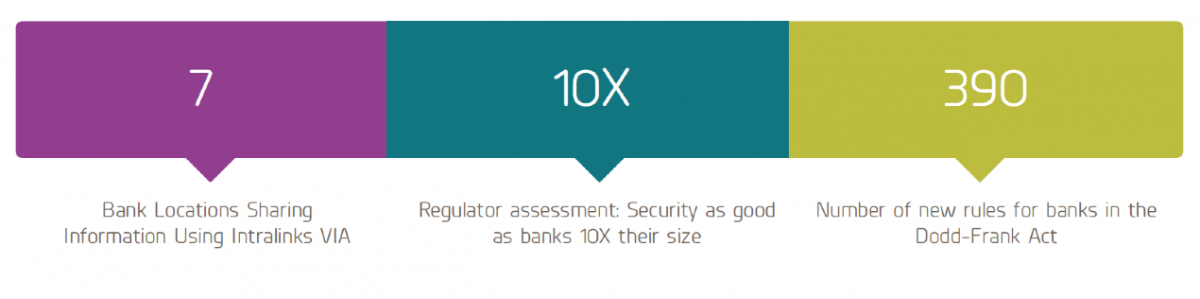

Like all banks, Midwest BankCentre must comply with a broad range of regulations such as Gramm-Leach-Bliley, the Home Mortgage Disclosure Act, Fair Lending Act, the Bank Secrecy Act, USA Patriot Act, and the Dodd-Frank Act, which includes 390 new rules that banks must follow. All of these regulations require that financial institutions maintain strong information security controls and granular auditability. As Midwest BankCentre grew, traditional tools, such as secure FTP and email encryption, were too functionally limited to meet growing information-sharing requirements. “Nobody wants to use secure FTP, and we tried multiple iterations of email encryption, but it was always extremely cumbersome for the receiving party,” Albrecht said. Albrecht determined that a modern cloud-based collaboration solution would provide the best mixture of simplicity, security, and scalability for Midwest BankCentre.

SOLUTION

Albrecht polled his professional network and one of the regulators with whom he works recommended he speak with Intralinks. The regulator said the Intralinks VIA cloud-based collaboration solution would deliver the combination of security, auditability, and ease-of-use needed to support compliance requirements while facilitating the free flow of information. “He said Intralinks’ solutions were already in use by a lot of our business partners – investment banks, legal firms, and others,” said Albrecht. “When one of your regulators recommends a product, you know it’s secure.”

Like most organizations, Midwest BankCentre worked hard to control employee use of “shadow IT” services, such as file sync and share. Before adopting Intralinks VIA, Albrecht would get complaints from employees because using “IT- approved” encrypted email or secure FTP was cumbersome and slowed them down, and they wanted to use the file sync and share services they used in their personal lives. “Once I started pointing them toward Intralinks, nobody ever complained again. It’s incredibly easy for them to use, and it delivers the levels of security and auditability required for us to meet our compliance and customer privacy needs,” he said.

According to Albrecht, Intralinks VIA solves this everyday secure file sharing need, while also providing a highly secure environment for working with bank examiners. “Examinations are traditionally done on site, often with paper-based documents,” Albrecht said. “Intralinks VIA lets us create a ‘virtual exam room,’ which makes it much easier for us to share information with examiners, without running the risk of exposing sensitive information. It makes the process much faster for us, and for the examiners.”

Since adopting Intralinks VIA, Albrecht has been told by examiners that Midwest BankCentre’s security protocols are much stronger than those found at most community banks. “One examiner told me he usually only finds this caliber of security at banks 10 times our size,” he said.

BENEFITS

Since implementing Intralinks VIA, Midwest BankCentre can complete many core processes much faster than before, including due diligence on loans and mortgages, examinations, audits, and more. Key benefits include:

- Users set up their own secure environments for sharing sensitive information with internal and external parties

- Employees share files easily without violating security policies

- Strong security and audit features ease compliance with regulations

- Cloud solution scales to support future acquisitions and expansion

- UNshare® any file or document, even after they have been downloaded

- and taken offline, using pre-set expiration dates